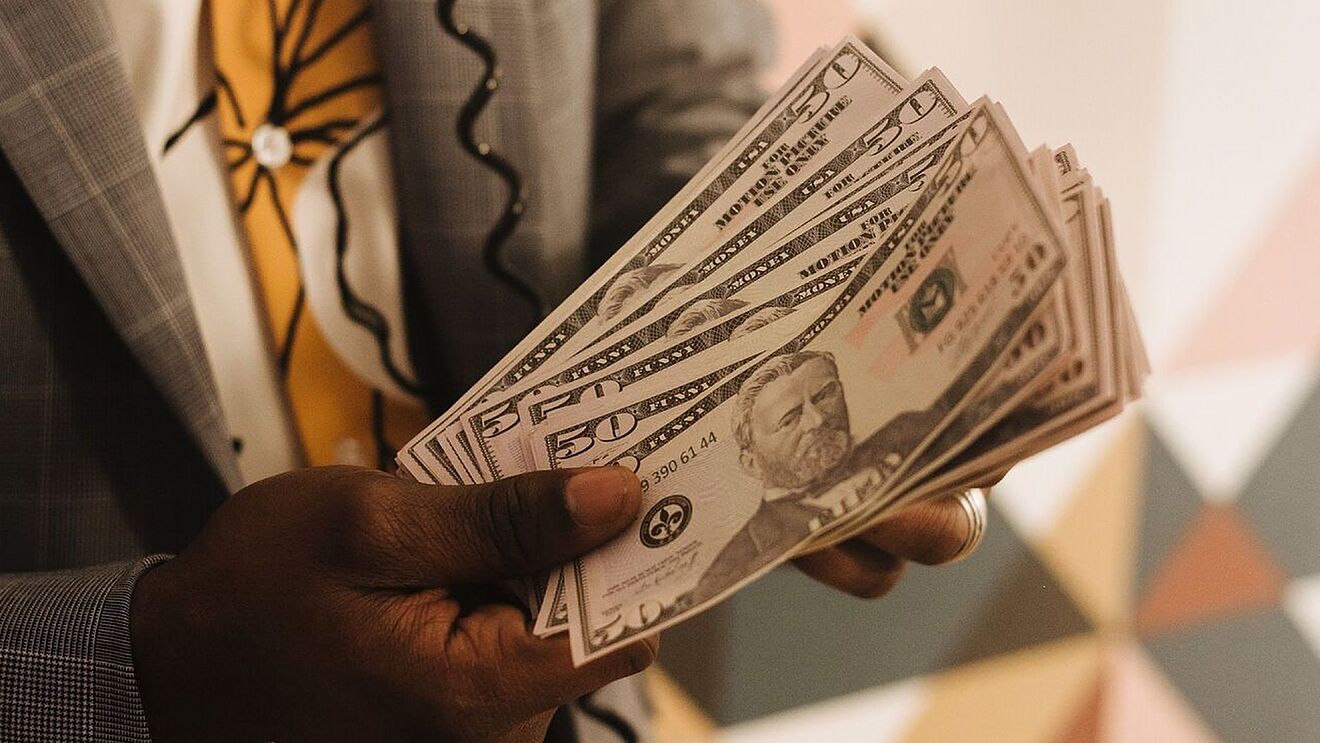

The California Inflation Stimulus checks are scheduled to be sent out in October. The California Franchise Tax Board (CFTB) has stated that payments will be issued on a sliding scale, with the lowest percentage of payments being given to taxpayers who qualify, and the highest percentage being given to those who do not qualify. Additionally, CFTB is planning to issue debit cards by January 14, 2023.

CFTB prepares to send out checks in October

The California Franchise Tax Board (FTB) has announced that it will begin sending out checks for the Middle Class Tax Refund (MCTR) to millions of residents by October. This is a part of a deal struck by lawmakers in June.

The MCTR is based on a taxpayer’s income, number of dependents, and filing status. The FTB estimates that approximately 18 million payments will be distributed over the next few months. These are the largest payments the state has ever distributed.

The MCTR will range from $200 to $1,050, depending on your income and number of dependents. The government is hoping that the payments will help offset rising gas prices.

The MCTR is a part of the state’s $308 billion budget package signed by Governor Gavin Newsom in June. According to the agency, the Middle Class Tax Refund will benefit up to 23 million Californians.

Aside from receiving a check, the majority of people who qualify for a MCTR will receive a debit card. They will be sent via a company called Money Network. Some have received their debit cards already, and the remaining will be mailed out in the near future.

People who haven’t received a debit card may have one in their mailbox in a couple weeks. If you’re expecting a direct deposit, make sure to use the correct address. You might also want to change the address on file, as the FTB can take a little longer to process your payment if you’ve moved since you filed your taxes.

Eligible taxpayers and dependents will receive their tax refunds through direct deposit

The IRS direct deposit program is an easy way for eligible taxpayers and dependents to receive their tax refunds. Direct deposit is an electronic transfer of funds that puts the refund into a bank account. It is a safe and secure way for taxpayers to receive their Federal payments.

Individuals and households are eligible to receive an additional $350 if they have qualifying dependents. This includes children, Social Security Disability Insurance beneficiaries, Railroad retirees and veterans.

To receive a payment, a taxpayer must provide a valid social security number and current mailing address. They can also verify their routing and account numbers. Some banks may not allow direct deposits, but others are more accommodating.

Taxpayers can check if they are eligible for a refund by e-filing their taxes. If you e-file, you will be able to receive your money quicker. However, you will need to verify your banking information when completing the tax form.

A prepaid debit card is also an option to get your refund. If you have a prepaid card, you should call your provider to check for a routing number. Also, make sure your bank account number is the same as your debit card number. Sometimes, banks will not accept direct deposits to a prepaid card.

Some financial institutions offer mobile apps to help people check on their refund. However, these applications are not as secure as direct deposit.

Payments will be offered on a sliding scale based on income and tax-filing status

The Middle Class Tax Refund is a refund program that was created in California in order to help those who are unable to afford the increased cost of living. The program will give Californians up to $1,050 in direct payments.

For a family with two children, the total payment would be $750. If there are three or more, then you can expect an additional $200 for each child.

To qualify, the family’s adjusted gross income must be under $75,000 for an individual or under $125,000 for a married couple. You can check your eligibility by using the calculator on the California Franchise Tax Board website.

In addition to the Middle Class Tax Refund, the state will also give out tax credits. These are based on the amount of money you earn in a year. There are also rebates for solar panels and cleaner energy sources.

Whether you qualify for the California stimulus checks depends on the amount of income and the type of filing status you have. Generally, the higher the income, the more benefit you’ll receive. But those earning more than $75,000 will not receive the full benefit.

The California stimulus check will be sent to debit card accounts. The FTB is distributing these payments in batches. It has been slower than expected to send out the first round of debit cards. Those who haven’t received theirs yet should still get a Money Network debit card.

Payments to people who didn’t previously receive a GSS payment by direct deposit began on October 7, 2022

The state of California is gearing up to begin sending out a stimulus check to more people than ever. While many states are also sending out one-time payments, California is unique in that it is sending out “inflation relief checks,” a form of direct payment designed to ease the effects of skyrocketing prices.

The California Franchise Tax Board (FTB) has slowly started releasing information on when and how the payments will be delivered. They hope to send out at least 9.5 billion dollars to 23 million Californians.

In July, the state legislature passed the Middle Class Tax Refund, a one-time direct payment to help offset the effects of record inflation. It is a $250 benefit to taxpayers earning up to $75,000 a year. An additional $350 is available to families with at least one qualifying dependent.

As of October, 1.6 million Californians have received a Golden State Stimulus check in the form of a debit card. The first wave of the payments will be sent out between October 7 and 25, and will be delivered through a direct deposit system.

The second wave of the Golden State Stimulus check will be mailed out between October 28 and November 14. Those who qualify will receive a physical debit card in the mail.

The timing of the payments is confusing, and they are being delayed. A few of the people who expected to receive a direct deposit were actually mailed a physical debit card instead.

Phased out payments

If you have lived in California for more than one year, you may have received a stimulus check. The payments were aimed at helping the state’s lower income workers. You can find out whether you qualify by using a tool provided by the IRS.

You will need to have a Social Security number to receive these payments. Adults under age 17 and senior citizens with valid social security numbers are eligible. For more information, visit the IRS website.

In October, the first round of stimulus checks was issued. Affected taxpayers were sent debit cards containing the payments. Approximately 8.3 million debit cards were distributed. This is a fraction of the 8.3 billion payments that have already been issued.

Since October, debit cards have also been mailed to individuals who did not claim direct deposit. The remaining debit cards are expected to be sent in the coming weeks.

As of December 3, more than eight and a half million residents of California have already received a stimulus payment. These are being distributed through additional tax rebates and directly to debit card accounts.

The payments are based on the adjusted gross income of the individual or household. Those with adjusted gross incomes above $250,000 are not eligible for these payments.

There are still two more rounds of stimulus payments that are planned. Each has slightly different rules. One of these is a Middle Class Tax Refund for those who made less than $500,000 in taxable earnings.

CFTB’s plan to issue debit cards by Jan. 14, 2023

The California Franchise Tax Board has updated the Middle Class Tax Refund shipping timeline. It has also updated the website with last names and addresses of tax collectors. Also, the CFTB website has added a link to the new DCC Compliance Program audit component. This includes an audit checklist and reminders for clients.

In the middle of this year, the California Franchise Tax Board proposed a rule that would require issuers to enable at least two unaffiliated networks for card-not-present debit card transactions. Issuers argued that such a requirement would increase the amount of fraud attributed to such transactions and the costs associated with implementing such a requirement. However, this proposal was opposed by the dual-message network industry and related trade associations, as well as the federal agencies who have authority over the debit card industry.

A number of comment letters were received from industry participants, including government agencies and related trade associations. These letters expressed a wide range of opinions. Some commenters argued that the proposal was unnecessary and could increase fraud, while others favored it because it may promote greater competition between networks.

While many commenters endorsed the idea of enabling merchants to choose between two or more unaffiliated networks, they raised concerns that the proposal went beyond what was required by the law. They argued that the term “enable” was not adequately defined and that the term “means of access” was confusing.