If you have been searching for a new way to manage your finances, try. This website offers finance and banking services that are based on real-time transactions and advanced tools. It offers digital payment services, and anyone can sign up for free. The website’s services let users manage their finances and set spending limits.

Sign up for a Wisely account

The Wisely card is a unique debit card that has a built-in EMV chip for total fraud protection. You can use the card to make purchases at more than a million online and physical locations, and there are no monthly service fees or minimum balance requirements. You can also use the card to deposit government benefits, pay bills, and more. It also lets you check your balance online or via your smartphone.

The Wisely card can be used anywhere MasterCard is accepted, including ATMs. In addition, it features a free built-in EMV chip and features a unique card number. There are no monthly fees, no minimum balance requirements, and no overdraft fees. You can use the card to receive government benefits and use the service anywhere MasterCard is accepted.

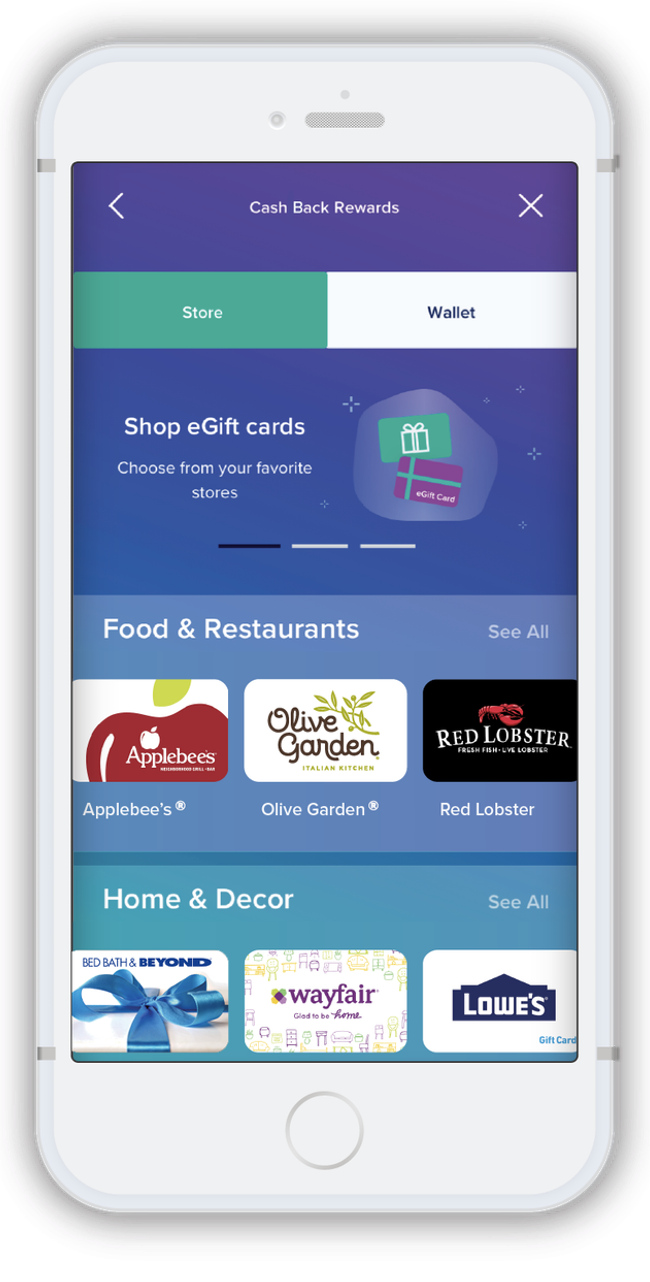

You can also use the Wisely app to monitor your spending habits. It will allow you to see your account balance, check your transaction history, and set up savings. The Wisely app also allows you to access your card balance and make payments through ATMs. It is an easy way to keep track of your finances and make smarter decisions.

The Wisely Card has a built-in EMV chip for security. It also allows you to load cash and check your balance at more than 100,000 locations worldwide. It also has a mobile app, so you can check your balance on the go from anywhere. This app is available for both iOS and Android devices.

In addition to providing a secure payment system, Wisely offers digital resources and tools that you can use to grow your personal brand and build your online reputation. To get started, you can sign up at and activate your Wisely card. There’s nothing better than being able to shop anywhere and save money at the same time.

To activate your Wisely debit card online, you must provide your personal information. You can use this card to shop online, and you can also register it over the phone by speaking to a customer support executive. The customer support executive will ask you to enter your PIN and your card details. During the activation process, you’ll never be charged for the card, but you will begin to pay a monthly service fee once you start using it.

Set spending limits

The Wisely Card helps you manage your spending habits and set spending limits. This prepaid card also includes a personal EMV chip for added protection against fraud. Its mobile app lets you track your purchases and see where you’ve spent the most. The Wisely website also helps you monitor spending by monitoring your card’s spending trends.

You can use your Wisely Pay Card at any retail establishment that accepts MasterCard. It also lets you withdraw cash from ATMs. The card costs nothing to apply for and comes with no monthly fee. You can use it to make purchases, pay bills, and get government benefits.

You can control your spending by setting spending limits on the Activate Wisely website. The card is accepted worldwide and gives you access to 1.5 million ATMs. It also gives you cash back at millions of stores and provides you with instant access to your money. It is a great way to manage your finances on the go.

To activate your card, log in to and input your three-digit CVV number and other personal information. Be sure to fill in your legal first and last name, birthdate, address, and telephone number. A four-digit PIN code is also required. Once you have activated your card, you can use it to buy goods online.

Wisely is a growing payment platform. It offers many rewards and guides you to spend money wisely. It helps you manage your money without the assistance of a financial advisor. Its excellent tracking system helps you keep track of your spending habits and provides alerts whenever you reach your spending limits. You can even set spending limits on your Wisely debit card.

Get paid up to 2 days early with direct deposit

If you have an account at a few banks, you may have the option to receive your paycheck up to two days earlier with direct deposit. With this option, you can start paying your bills, saving money, and investing earlier. Just make sure you check with your bank to find out which of these banks offers this option.

Early direct deposit is a relatively recent feature that allows consumers to receive their paycheck earlier. This allows you to pay bills earlier and earn interest sooner. It can be particularly helpful if you receive your paycheck on a weekend. It can also help you avoid paying overdraft fees.

The main difference between regular direct deposit and early direct deposit is how payment processing takes place. Regular direct deposit deposits your paycheck after it is processed by the employer, whereas early direct deposit deposits your paycheck before the payment is made. Both of these methods require that your employer submit payment instructions and settlement information in advance.

Direct deposit is the most secure way to get paid. Because you receive your paycheck electronically, fewer hands touch it. This means less risk of lost checks or other problems. Plus, you can get paid up to two days earlier than if you waited for a check to arrive in the mail.

With direct deposit, you can get paid early for holidays and other days. You can set up direct deposit for free. Simply copy and paste your account information on the site and you will receive an email with a direct deposit form. Unlike traditional bank accounts, direct deposit doesn’t require a credit check or a minimum deposit. You can even use it if you’re a sole proprietor.

Direct deposit is a convenient and hassle-free method for most American workers. By setting up direct deposit with your bank, you can receive your paycheck up to two days earlier than you would otherwise. It helps you to avoid a lot of problems with unexpected bills and expenses, and gives you access to your paycheck funds sooner.

Access your card account anywhere, anytime

You can access your card account online or on your mobile device whenever you want. These websites and mobile apps offer many benefits, including security and privacy. They also allow you to set rules and alerts to prevent fraud and limit card use. In addition, these sites and apps are highly encrypted and secure, so you can access your account with complete peace of mind.